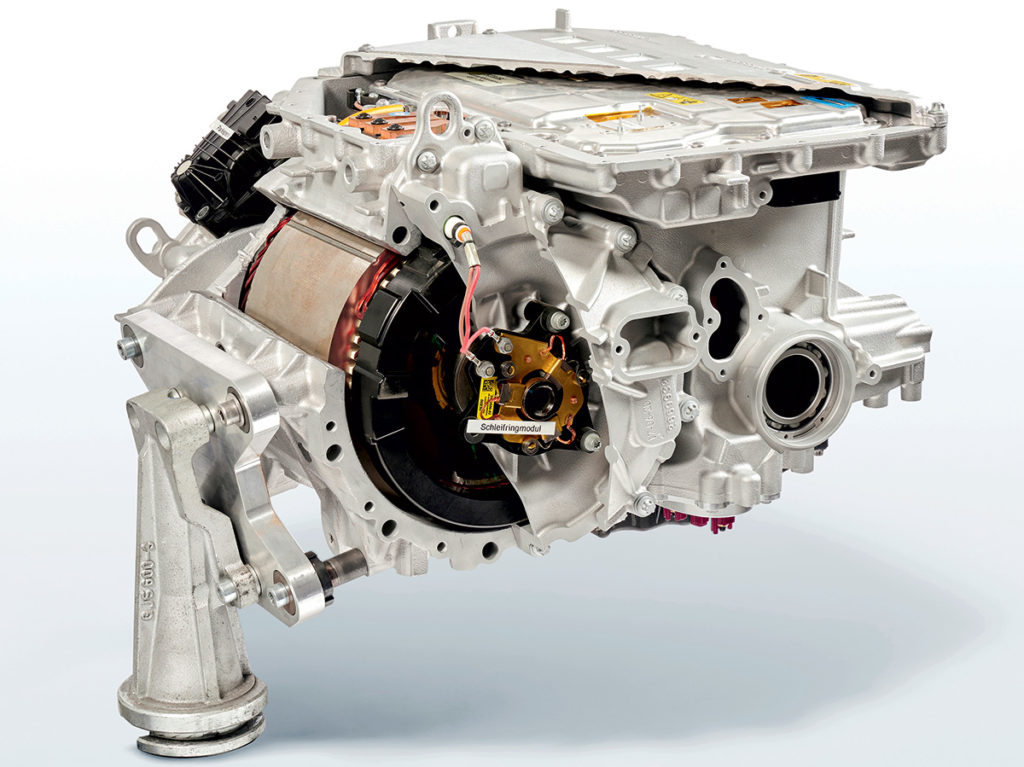

Everything old is new again: BMW’s fifth-generation eDrive features a wound-field synchronous AC motor

Brushed DC (and AC/DC universal) motors are much maligned for a number of reasons, but one of the chief—if, perhaps, somewhat exaggerated—complaints is that the graphite brushes, and the segmented copper commutator they ride on, wear out over time, all the while producing an incredibly fine—and potentially dangerous—conductive carbon and copper dust in the process. So, BMW’s choice of a brushed motor for its 5th-generation eDrive technology (which debuted in vehicles like the 2022 BMW iX M6) would seem to be a step back in technological progress—and in some ways it is. But this is a brushed AC motor, more formally known as a wound-rotor (or field) synchronous AC motor, and here the brushes and slip rings (not a commutator—more on that below) have a much easier life than in their brushed DC counterparts. This has a tremendous impact on the expected service life of the motor, but it also allows for far more control of the motor’s speed and torque in all four quadrants of operation (i.e. motoring and regenerating in both forward and reverse). In fact, the wound-field synchronous AC motor is a direct analog of the separately-excited DC motor, and they behave very similarly from both the perspective of the load and the top-level control scheme, despite their starkly different physical constructions.

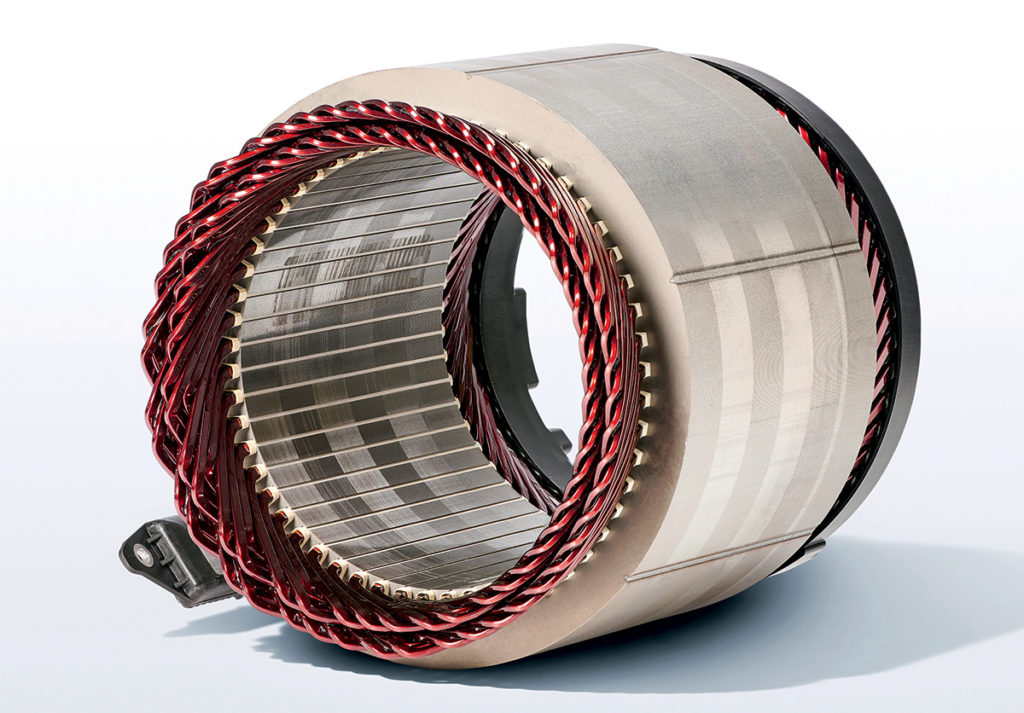

The wound-rotor synchronous motor (WRSM) uses a radial array of electromagnet coils in the rotor for its field, rather than the permanent magnets that are either placed on the surface of, or embedded into, the rotor of the permanent magnet synchronous motor (surface and interior PMSM types, respectively). The PMSM is by far the most popular type of traction motor currently used in EVs, so a review of its characteristics will be helpful to better understand why an OEM like BMW might choose to go with the WRSM instead.

The permanent magnet synchronous motor is by far the most popular type of traction motor currently used in EVs, so why would an OEM like BMW choose to go with the wound-rotor synchronous motor instead?

Both styles of PMSM—interior and surface—invariably use rare earth magnets for the rotor field, because they maximize two qualities that are important in this application: a high field strength (typically in the range of 0.9 to 1.2 Teslas), and a high coercive force, or resistance to demagnetization. Since torque is proportional to the magnetic field strength produced by the motor’s field, stronger magnets are preferred (most of the time, anyway), and since the field/rotor magnets in a motor are subjected to opposing fields from the armature/stator, resistance to demagnetization is absolutely critical. As good as rare earth magnets are, however, they are not perfect by any means, and one of the chief downsides to them is they are expensive (the word “rare” sort of gives it away). Another major shortcoming of rare earth magnets is the fact that their resistance to demagnetization starts dropping at a painfully low temperature—as little as 80° C for the neodymium type, in fact—which can unduly restrict the amount of continuous power that a given motor can deliver.

Operationally, a PM field is both a blessing and a curse (but mainly the latter). On the plus side, having the full field strength available at all times makes it easier for the PMSM to deliver a predictable maximum torque starting at 0 RPM, especially compared to an induction motor. On the minus side, back EMF—or the voltage generated by the motor which opposes its supply—is proportional to field strength and RPM, so the top speed is severely limited in a PMSM without either employing field weakening or a ridiculously high battery voltage. Unfortunately, field weakening in a PMSM requires actively suppressing the field from the PMs, which risks demagnetizing them (especially at elevated temperatures). Furthermore, a catastrophic failure mode called uncontrolled generation can occur if the field weakening abruptly ceases while the motor is still spinning at a high RPM (from, say, the inverter faulting off, or a loss of rotor position feedback, etc.). Should this occur, the BEMF will suddenly shoot up to a much higher value, which would greatly exceed the battery voltage, if it weren’t for the fact that the battery will clamp that voltage hard. So, instead, a huge amount of current will flow from the PMSM back to the battery through the anti-parallel diodes across each bridge switch in the inverter, destroying them. Failure modes aside, the interior PMSM can usually tolerate more field weakening than the surface type because burying the PMs in the rotor partially shields them from demagnetization, and also allows for higher rotational speeds without having to worry about the magnets suddenly ungluing themselves to punch a hole through the stator. That said, the rotor in the IPMSM is far more expensive to manufacture—those magnets don’t bury themselves, after all.

The other motor most commonly used in EVs (though less so these days) is the AC induction type, or ACIM. In some respects it is more like the WRSM than is the PMSM, in that the field can be controlled (albeit indirectly), and there is no risk of uncontrolled generation. That said, the cynic in me suspects that the real reason the ACIM is (or was) so popular is because it is one of the cheapest types to manufacture, as it’s not terribly well-suited to traction applications. This is because it requires very computationally-intensive control schemes to deliver high peak torque at 0 to low RPMs, and even then, it is difficult to get a peak torque of more than about 3x the nominal rating, regardless of what sort of black magic the inverter algorithm might employ. Also, the amount of torque depends on poorly controlled and/or difficult-to-estimate parameters such as rotor bar resistance and inductance. Nevertheless, the ACIM is one of the most physically robust motor constructions that can tolerate a lot of environmental (or operational) abuse, which is definitely a point in its favor for automotive use, even if it isn’t as power-dense as the PMSM, or as good at producing gobs of torque at a dead stop, like the series DC motor.

Given that the WRSM uses electromagnets for its field instead of permanent magnets, it’s clear that the two big downsides to the PMSM will be rendered moot. But there is a price to be paid.

Given that the WRSM uses electromagnets for its field instead of PMs, it’s clear that the two big downsides to the PMSM mentioned above will be rendered moot right off the bat. The price paid is that those field electromagnets need to be supplied with power, a task which falls upon a pair of brushes and slip rings (though, of course, on the inverter itself, ultimately). While slip rings and commutators are both examples of a freely-rotating electrical connection, and both use carbon brushes in the motor housing to deliver power to the rotor, the similarities end there. A commutator is so named because it energizes each coil in the armature (of a DC machine) in succession as the shaft rotates. This is a hard life for both brushes and commutator for several reasons: (1) the armature is where the vast majority of the power in a motor is handled, so the brushes and commutator have to deal with high currents; (2) the inductance of each armature coil stores energy (proportional to 0.5LI2) which causes an arc every time its pair of commutator segments are disconnected from the brushes; (3) the commutator segments have to be insulated from each other and the resulting gaps and insulating material can subject the brushes to impact loads if the commutator is not resurfaced periodically; (4) to handle high currents the commutator segments need to be made out of copper, but copper is a relatively soft metal, so it wears poorly. The slip rings in a WRSM, however, are supplying the relatively low power field with DC, so none of the above four issues apply. In fact, the humble automotive alternator is a type of WRSM and when one fails, it is almost always the electronic components (rectifier bridge or field regulator module) that are at fault, not the slip ring assembly.

If the field in a WRSM is supplied with a constant current, then it will behave exactly like a PMSM (minus the risk of catastrophic demagnetization, of course). This is a rather unsophisticated control scheme, though, and the usual approach is to vary the field current with the torque demand below synchronous speed, then reduce its maximum value proportionally with RPM above synchronous speed (i.e. the field-weakened region of operation). A rather under-appreciated benefit of matching the field excitation to the torque demand is that the WRSM will present as a unity power factor load to the inverter. This eliminates the reactive current that would otherwise slosh back and forth between the inductance of the motor windings and the DC link capacitance, doing no useful work in the process, but still heating up the bridge switches and anti-parallel diodes. In contrast, the ACIM always presents a lagging (inductive) PF, leading to high switching losses in the bridge switches if IGBTs are used (due to their slow turn-off), whereas the PMSM usually presents a leading (capacitive) PF (however, see below) leading to high switching losses if MOSFETs are used (due to energy stored in the drain-source capacitance). Since MOSFETs have all but supplanted IGBTs in EV inverters, the usually-leading PF of the PMSM is a slight disadvantage over the WRSM, then.

Another potential advantage of the WRSM over the PMSM is that electromagnets can achieve a higher field flux intensity than even the strongest rare earth PMs (depending mainly on the saturation limit of the particular grade of electrical steel used to construct the rotor and stator) which could actually reduce the size of the motor for a given power output. For example, pure iron can withstand about 2.3 T before saturating, while the typical grades of silicon steel used in transformers and motors can take 2 T, both of which comfortably exceeds the 1.4 T or so that the strongest Nd magnets can produce, much less the 1.2 T max for Nd magnets with a high enough maximum operating temperature rating to be usable in a motor. However, the AC losses of pure iron make it a poor choice for the stator, and while the rotor does not experience such losses, it does need to be reasonably strong to hold itself together, both from the torsional forces of torque production as well as centripetal force at high RPMs, and pure iron has too low a tensile strength. Also note that the space required by the copper windings for the electromagnets could partially or even completely nullify the advantage of the 40 to 90% or so higher saturation limit.

The WRSM doesn’t use rare earth magnets, so it can survive higher temperatures, and is immune to demagnetization. Its torque and speed are more controllable, it can’t turn into an uncontrolled generator, and it can be operated at unity power factor. A rather compelling list of pluses.

In conclusion, the WRSM doesn’t use expensive and environmentally-unfriendly rare earth magnets, so it can survive higher temperatures, and is immune to demagnetization. Compared to its PMSM counterpart, its torque and speed are more controllable, it can’t turn into an uncontrolled generator (as long as the field supply turns off in the event of an inverter fault), and it can be operated at unity power factor. That’s a rather compelling list of pluses, so perhaps we’ll be seeing more of them in EVs in the future.

This article appeared in Issue 60: April-June 2022 – Subscribe now.

Source: Electric Vehicles Magazine