The British company’s CEO explains why Caterham had to repurpose parts from other carmakers.

Source: Electric Vehicle News

Tesla Cybertruck Spotted With Calibration Equipment In California

The Austin-based EV maker is already assembling release candidate vehicles at its Texas Gigafactory.

Source: Electric Vehicle News

California: Tesla Beat Toyota As BEV Sales Surge In Q2 2023

The volume of all-electric car sales for the first time exceeded 100,000 in a single quarter.

Source: Electric Vehicle News

Here’s Why The Audi Q6 E-Tron’s Active Headlights Won’t Be Offered In The US

Outdated Federal safety standards continue to keep US-spec vehicles one step behind the rest of the world.

Source: Electric Vehicle News

Rivian SUV Owner Shares First Impressions

Darrell Woo has previously shared with us about his Teslas and his father’s Ioniq 5. He also uploads a lot of videos about EVs on his YouTube channel. Recently, he replaced his Model Y with a Rivian SUV. It seemed like a good opportunity to get some inside information on this intriguing EV, so I […]

Source: CleanTechnica Car Reviews RSS Feed

Updated Chevrolet Bolt EV coming, using newer Ultium cells

The other shoe has dropped on GM’s decision to take its only volume EV model out of production: a revised Bolt using the new Ultium battery is coming.

General Motors CEO Mary Barra said this morning an updated Chevrolet Bolt EV will come to market “on an accelerated timeline,” with new Ultium battery cells replacing the LG Chem design used in the current model. In April, GM said the Bolt would go out of production by the end of this year.

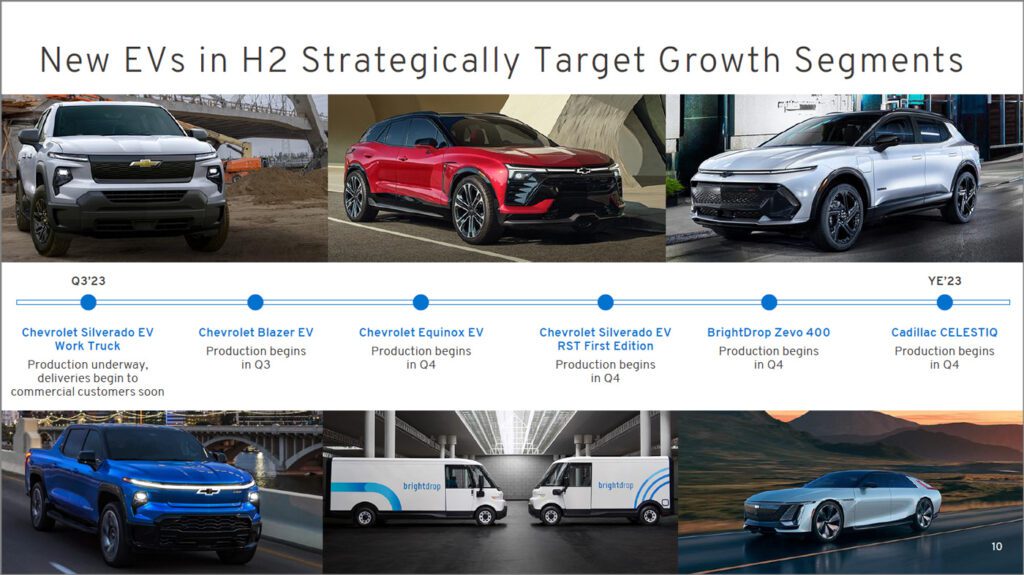

The announcement of the updated Bolt came during GM’s second-quarter earnings call, on which Barra was questioned about the slow rollout of the company’s long-awaited volume EV lineup: Chevrolet Silverado EV full-size pickup truck, Chevy Blazer EV mid-size SUV, and Equinox EV small SUV. Those vehicles, along with the GMC Hummer EV and Cadillac Lyriq, rely on production of new Ultium battery cells from three new plants in Warren, Ohio; Spring Hill, Tennessee; and Flint, Michigan.

GM had expected production of those Ultium cells to ramp up much faster, Barra said. She cited delays in battery-pack production owing to delays by an “automation supplier,” but provided no further specifics.

Update, not a clean-sheet design

“We will keep the [EV] momentum going by delivering a new Bolt,” said Barra. “And we will execute it more quickly [than] an all-new program, with significantly lower engineering expense and capital investment, by updating the vehicle with Ultium and Ultifi technologies and by applying our ‘winning with simplicity’ discipline.”

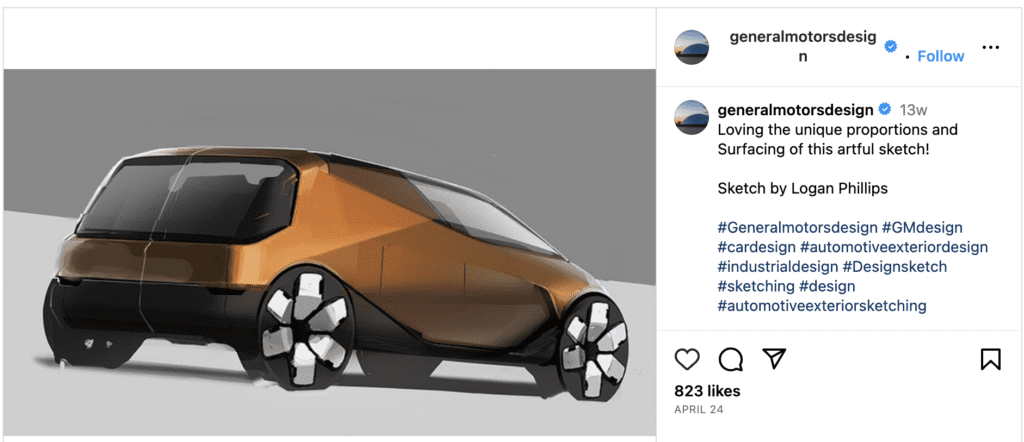

Few other details are known about the next-generation Bolt EV. GM said only, “Timing and specific details about the next-generation Bolt will be announced at a later date.” A possible clue to a new design may come in a rendering posted on the GM Design Instagram feed late in April. The caption noted the “unique proportions and surfacing” of the sketch by Logan Phillips.

How GM fits its Ultium cells into a vehicle that may use some or much of the current Bolt’s understructure remains to be seen. The rectangular Ultium cells used in North America appear too wide to install them in the two parallel rows seen in the Equinox and Blazer EVs. GM has long touted the flexibility of its Ultium cells, however, which can be packaged into modules of different shapes for everything from low passenger and sports cars to tall full-size trucks and SUVs.

“With GM struggling to scale-up its next-generation EV offerings, course-correcting and not ending the Bolt’s future—which has achieved a sort of cult-classic status—is a smart step,” said Corey Cantor, senior associate for EVs at Bloomberg New Energy Finance.

Bolt just hitting its stride

A new Bolt makes increasing sense given that the current models—one now in its seventh model year—are having their best year to date. In May 2021, GM rolled out its larger Bolt EUV version and recast the pair of Bolt hatchbacks as EV value entries. But within weeks, it had to stop sales due to roughly a dozen Bolt battery fires. Those ultimately led to a recall of tens of thousands of vehicles to replace their packs, for which LG Energy Solutions ultimately reimbursed GM the cost of $1.9 billion.

This year, though, GM noted that first-half sales of Bolt EV and Bolt EUV have been the strongest since the first deliveries of Bolt EVs in December 2016. From January through June alone, Chevrolet delivered 33,659 Bolts—against 38,000 for all of last year. That first-half total compares to 2,316 Lyriqs and a mere 49 Hummer EVs (a vehicle going through its own battery recall).

In other words, the Bolts made up the bulk of GM’s EV sales for the first half of the year during which the Ultium models were going to hit the market. On the call, Barra confirmed the company’s goal of 50,000 EVs built (not sold) in the first half, plus a further 100,000 from July to December.

Barra first telegraphed a new Ultium-based Bolt during a radio interview in June. It makes considerable sense: It’s the company’s best-known EV nameplate, especially now it’s no longer confused in showrooms with the discontinued Chevrolet Volt plug-in hybrid. And with Chevrolet now entirely an SUV and truck brand (excepting the largely ignored Malibu mid-size sedan), the Bolt was the only way Chevy could bring new customers into the brand. “Nearly 70 percent of buyers who are trading in a vehicle for [a] Bolt are trading in a non-GM product,” the company said—and 80 percent of them plan to stay loyal to Chevy.

Low-cost competition from China?

Plans for an updated Bolt may also have been spurred by the appearance of the 2025 Volvo EX30 subcompact SUV. The 268-hp rear-drive model of the EX30 sports a premium brand, a claimed range of 275 miles—and a starting price of $36,145. Note that number includes the 27.5-percent U.S. import duty levied on any vehicle built in China (Sweden’s Volvo is owned by China’s Geely).

While GM has promised a “$30,000 Equinox EV” at some point in the future, it’s not likely to appear immediately. Slotting in a redesign Bolt below the Equinox EV lets Chevy continue to offer an “entry level” EV with a starting price akin to the current model’s, currently $27,800.

“It’s no surprise that GM is planning on keeping the Bolt EV alive,” said Jessica Caldwell, executive director of insights at Edmunds. “Barra’s move recognizes the fact that EV prices must move downward in order to encourage mass adoption. Middle-income Americans currently face not only high vehicle costs but also high interest rates. While there is currently a robust selection of EVs at high prices, there are far fewer choices at the lower end—the market niche the relaunched Bolt will fill.”

BNEF’s Cantor stressed EV affordability as well. “In a few short years, the U.S. will see a more competitive EV market in the below-$35,000 price range—from vehicles including Tesla’s next-generation EV and Volvo’s EX30. The Bolt, if upgraded properly, gets a head start from its existing brand name and lets GM occupy an important space in the burgeoning entry-level EV market.”

But, Cantor warned, “The questions remaining are less about the potential for a next-generation Bolt and more about GM’s ability to scale its Ultium platform. This announcement shows GM recognizes the potential space its new EVs should occupy, but does nothing to alleviate the battery-related challenges the company continues to face.”

Source: GM

Source: Electric Vehicles Magazine

Zonar partners with ChargePoint and Highland on electric school bus charging management

Zonar, a provider of smart mobility solutions for fleets, has formed strategic relationships with ChargePoint and Highland Electric Fleets, a provider of fleet electrification-as-a-service. Zonar will use ChargePoint’s integrated hardware, software and services. Highland will provide telematics insights to Zonar’s customers through its Dashboard platform, in partnership with Synop.

ChargePoint will offer Zonar customers expert consultation for charging infrastructure planning and deployment—a dedicated project management team will handle every step of the process, from design to equipment procurement, contract negotiation and construction oversight.

“Through this agreement, more school bus fleets will have access to ChargePoint’s portfolio of integrated hardware, software and services that simplify the shift to electrification and deliver lower total cost of ownership for fleet managers,” said Rich Mohr, ChargePoint Senior VP, Fleet.

Highland Electric Fleets will use Zonar’s V4 telematics control unit to provide real-time data on bus location and each bus battery’s state-of-charge. This offers insight into range awareness to properly manage bus charge scheduling and routing.

“Our goal is to maximize the efficiency of EV bus fleets, using them for as many hours of the day as possible, and most importantly, in the safest way,” said Sean Leach, Director of Technology and Platform Management at Highland. “Zonar offers us effortless access to knowing what each bus is doing minute by minute.”

“Transitioning to electric without disrupting existing fleet operations and infrastructure is possible,” said Zonar VP Tim Ammon. “At Zonar, we are continually working with partners and customers in the EV bus ecosystem to improve our services and support for fleets on their EV adoption journey.”

Source: Zonar

Source: Electric Vehicles Magazine

IRA incentives set off battery recycling gold rush

As numerous EV execs have told Charged in recent months, the “buy American” provisions of the IRA and BIL are driving massive investments in domestic mining and processing for EV battery raw materials. Now a similar gold rush appears to be gathering speed in the battery recycling field.

The voluminous Inflation Reduction Act includes a clause that defines EV battery materials recycled in the US as American-made, regardless of their origin—so EVs made with US-recycled battery materials should be eligible for the IRA’s purchase incentives.

Reuters recently interviewed more than a dozen EV industry insiders, who said that the IRA’s recycling provisions are spurring a US factory building boom, as well as encouraging automakers to accelerate their research into battery recycling. There are at least 80 companies involved in EV recycling around the world, and some 50 startups have attracted over $2.7 billion in investment in the last six years.

BMW Sustainability Chief Thomas Becker told Reuters that the minerals in a typical EV battery—primarily lithium, cobalt and nickel—are worth somewhere between $1,100 and $2,200. (So much for the oft-repeated and long-rebutted trope that EV batteries will end up in landfills.)

Demand for these materials is bound to grow as automakers ramp up EV production, but they can theoretically be recycled an infinite number of times.

JB Straubel, the CEO of Redwood Materials, has long recognized the importance of building a closed-loop circular supply chain. Straubel famously said that “the largest lithium mine could be in the junk drawers of America,” by which he meant that not only EVs, but consumer products, could be a source of recycled materials. Redwood and others also process a good deal of raw materials recovered from scrap discarded in the battery-making process.

A host of companies are building recycling facilities in the US and Europe (Ascend Elements, Li-Cycle, Altilium Metals). However, the vast majority of recycling currently takes place in China—Reuters reports that there is “little existing US recycling capacity today, and virtually none in Europe.” And the Chinese aren’t waiting around for others to catch up—the country recently announced more stringent recycling standards and increased support for research.

Source: Reuters

Source: Electric Vehicles Magazine

Tesla hopes to double the size of its Berlin Gigafactory

When Tesla built its Gigafactory 4 in Grünheide, Germany, near Berlin, it was a shot across the bow (or a “wake-up call,” or a “poke in the eye”—pick your favorite metaphor) to German automakers, who have since fallen far behind in the EV race (Model Y was the best-selling car in Europe in the first half of this year).

Now Tesla wants to double the production capacity of the Berlin Gig, to one million vehicles per year, which would make it the largest auto plant in Europe, eclipsing Volkswagen’s factory in Wolfsburg, which was built in the 1930s and currently produces some 815,000 cars per year.

Since March 2022, Tesla’s German Gig has been producing about 5,000 Model Ys per week—roughly half the plant’s current capacity.

According to a multi-thousand-page proposal that Tesla recently made public, the company wants to add capacity to build other unspecified models, and to double its production of battery cells to a storage capacity of 100 GWh per year.

From the beginning, Tesla has faced resistance from local residents, who are concerned about the factory’s use of groundwater, among other issues. The company’s expansion proposal includes the construction of a water treatment facility that would allow the factory to recycle water.

Under local law, residents have one month to examine Tesla’s proposal and submit any concerns to authorities. A public hearing will be held in October.

Tesla held a meeting with residents last week, at which the company promised to increase the number of employees from 10,000 to 22,500. The New York Times reports that there are already “dozens of jobs” advertised on the company’s web site.

Dirk Schulze, Regional Head of the local IG Metall labor union, sounded ambivalent about the proposed expansion. “Despite high levels of sick leave, staff are being cut on a significant scale,” he told the Times. “But production targets are not being adjusted downward, so pressure on the remaining colleagues is increasing.”

Source: New York Times

Source: Electric Vehicles Magazine

ZeroAvia to test hydrogen–electric regional jets with MHIRJ

British-American hydrogen aircraft manufacturer ZeroAvia has identified applications for hydrogen-electric, zero-emission propulsion for regional jet aircraft.

The hydrogen-electric CRJ aircraft would be equipped with two ZeroAvia regional jet engines (derivatives of the ZA2000 engine class) to match the existing performance, and ZeroAvia analysis suggests it could support up to 60 passengers with a range of up to 560 nautical miles, covering more than 80% of current flights.

The company has also identified an initial entry point for a CRJ 700 retrofit with ZeroAvia’s ZA 2000RJ powertrain, confirming the maximum takeoff weight, center of gravity and structural allowance. The results come from a technical study conducted alongside Type Certificate holder MHIRJ over the last year.

The study also identified opportunities for onboard hydrogen fuel storage and powertrain integration to ensure the preservation of aircraft aerodynamics. The technical assessment found that the loss of turbine core thrust could be overcome within the constraints of the original airframe with increased fan diameter, while further efficiency gains were possible by adopting novel propulsor technologies such as geared, ducted electric fan or open rotor designs.

The assumptions based on the Phase 1 study included HTPEM fuel cell system-specific power of 2.4 kW/kg. ZeroAvia has already achieved 2.5 kW/kg at the cell level of its HTPEM stacks and plans to deliver 3 kW/kg system-level specific power within two years.

ZeroAvia’s prototype ZA2000 hydrogen-electric system for 40-80 seat regional turboprop aircraft will soon be tested aboard a 76-seat Dash 8-400, with a target of certifying the technology for use as early as 2027.

“There is some payload and range compromise, but this technical study confirms a viable propulsion architecture and integration which could be transformational,” said Val Miftakhov, CEO of ZeroAvia. “Before the end of the decade, airlines could be flying zero-emission jets.”

Source: ZeroAvia

Source: Electric Vehicles Magazine