This has to be one of the strangest Tesla FSD-related incidents we’ve come across, but luckily nobody was hurt.

Source: Electric Vehicle News

Mercedes-Benz EQS Exceeds EPA Rating In Edmunds Range Test

They tried the EQS 450+ with the 107.8 kWh battery and easily smashed through the 350-mile EPA range.

Source: Electric Vehicle News

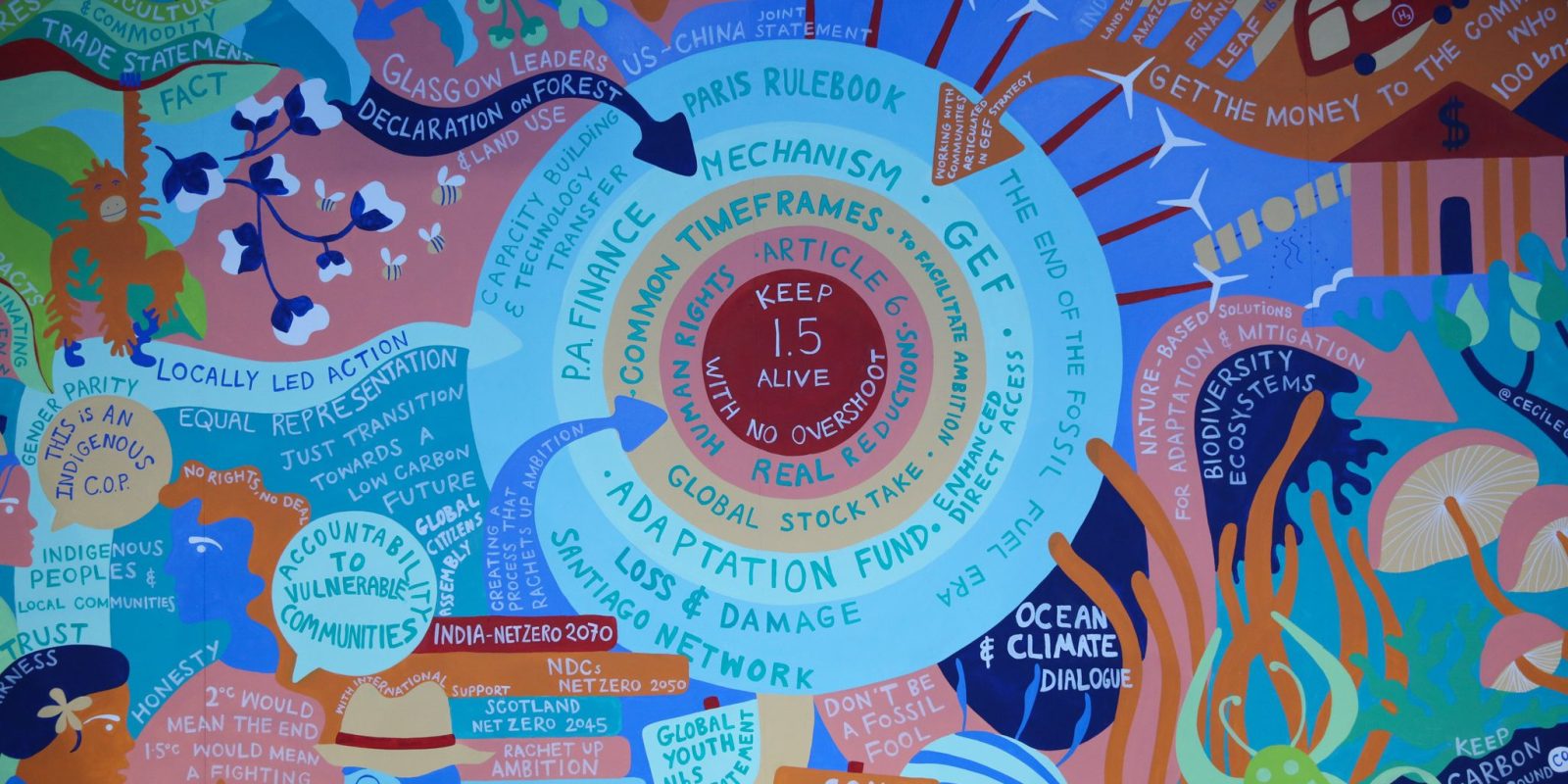

COP26 ends with Glasgow Climate Pact – and we still need to work harder

COP26, the 26th meeting of the United Nations Framework on Climate Change’s Conference of Parties has ended with the successful negotiation of the Glasgow Climate Pact, which updates the landmark Paris Agreement with new climate goals (full text here). The new Pact moves forward timelines for updating national goals for carbon reduction and for the first time explicitly calls for a “phase-down” of coal globally.

But experts warn that the new commitments are not strong enough and will still need to be updated, as soon and as strongly as possible, if we want to keep warming below 1.5ºC above pre-industrial levels.

The post COP26 ends with Glasgow Climate Pact – and we still need to work harder appeared first on Electrek.

Source: Charge Forward

Closer look at Juiced Bikes’ new 28 MPH ‘fun-sized’ RipRacer electric bike

Last week the San Diego-based electric bicycle company Juiced Bikes unveiled its newest e-bike, the RipRacer. The bike features a smaller frame and 20″ wheels, making it ideal for for either smaller riders or city dwellers that want an elevator-friendly, space-conscious ride.

The post Closer look at Juiced Bikes’ new 28 MPH ‘fun-sized’ RipRacer electric bike appeared first on Electrek.

Source: Charge Forward

Rivian becomes one of the world’s most valuable automakers—with no revenue

Are investors farsighted or foolhardy? A little of both, in our view—but there’s no question that Wall Street believes in an electric future. EV startup Rivian went public last week, raising nearly $12 billion to give the company a valuation of around $77 billion. Since then, RIVN stock has soared, making the company one of the world’s most valuable automakers.

As of this writing, Rivian is worth more than Daimler, GM or Ford, which owns a 12% stake in the startup. Another dubious distinction: Rivian is now the most valuable US company with no revenue (Lucid previously held that coveted title).

The company has just begun producing its R1T electric pickup truck, and so far, it has delivered only a handful. However, it claims to have some 55,000 reservations for the pickup and the R1S SUV, and has big ambitions to produce 1 million vehicles by 2030.

It’s an impressive start, but not unexpected. Ever since it stole the show at the 2018 LA Auto Show, Rivian has been considered the cream of the latest crop of startups. The support of Amazon, which owns a chunk of the company, and has ordered 100,000 electric delivery vans, is a huge asset. CEO R.J. Scaringe is by all accounts extremely well-qualified, and has thus far shown no tendency to alienate supporters with stupid public statements, or to embroil his company in shady scandals. The fact that Rivian chose to take the traditional IPO route, instead of the low-budget SPAC shortcut, only adds to the company’s air of seriousness and respectability.

Rivian is off to an excellent start, but now it must navigate the Valley of Death—that is, it has to ramp up production enough to start bringing in revenue before investors lose patience and cut off the cash spigot. The ramp-up will consume billions of dollars over the next couple of years—Rivian said in a financial filing that it did not expect to fulfill the 55,000 orders for the truck and SUV until the end of 2023. The Amazon deal should help, providing a handy cash cushion that (for example) Tesla never had. Amazon hopes to have 10,000 of the Rivian e-vans on the road next year.

Rivian’s target customers are wealthy and adventurous, and so are its investors. A successful Rivian is precisely what the EV industry needs at this moment—an all-electric rival for Tesla and an additional goad for the Dinosaurs of Detroit. Let’s hope Rivian can “keep the world adventurous forever.”

Sources: Electrek, New York Times, Al Jazeera, CNBC

Source: Electric Vehicles Magazine

XPeng Teases A New SUV Model Ahead Of Auto Guangzhou 2021

“A new breed. Coming soon. Stay tuned.”

Source: Electric Vehicle News

Quick Charge Podcast: November 13, 2021

Listen to a recap of the top stories of the day from Electrek. Quick Charge is available now on Apple Podcasts, Spotify, TuneIn and our RSS feed for Overcast and other podcast players.

The post Quick Charge Podcast: November 13, 2021 appeared first on Electrek.

Source: Charge Forward

Report: Geely To Launch A High-End Electric Pickup Truck

Will it compete with Rivian?

Source: Electric Vehicle News

Lucid Air Production Cars Spotted At The Lucid Plant In Arizona

They appear to be ready for the next batch of deliveries.

Source: Electric Vehicle News

Watch Tesla Model S Plaid Over Accelerate On Autocross Circuit

It has so much power and torque that it had to be kept in Sport mode instead of Plaid.

Source: Electric Vehicle News